The year-end reports are out for the Park City Board of Realtors. For those who like to settle down in front of the fire with a glass of sherry and a massive binder full of charts, this link is for you: 12 Month Rolling Average January 2015 – December 2016 / January 2014 – December 2015

For those of a more visual persuasion, here is the Park City MLS Trend Statistics Charts.

And for those of you that like your facts drilled down a little bit, here is the official press release from my last Statistics Committee Meeting at the Park City Board of Realtors:

Park City, Utah – February 1st, 2017

2016 year-end housing statistics for Summit and Wasatch Counties, as reported by the Park City Board of REALTORS® Multiple Listing Service, show that over the past four years, the number of closed, pended, and active listings has continued to trend at a healthy and stable rate, with an averaged median price increase of 7.5% annually. However, in 2016, the median sales price for single-family homes, condominiums, and vacant land increased at a rate double that number. Overall, the quantity of sold properties did not increase sharply over previous years, yet the dollar volume for our entire market area was up 18%.

President of the Park City Board of REALTORS®, Sara Werbelow adds, “We have experienced a sustainable growth trend for several years. Areas surrounding Park City Proper, such as the Heber Valley and Jordanelle, are proving to be a consistent and robust draw for both primary and secondary homeowners, as buyers are capitalizing on new construction and great value.”

Single-Family Home Sales

Activity within the City Limits (84060)

With limited inventory and high demand for single-family homes within the City Limits, the median price climbed to $1.69 M.

- Lower Deer Valley doubled in the number of homes sold and saw a 15% increase in median price reaching just under $2.2 M.

- Park Meadows, consistently in high-demand, experienced seven fewer sales than in 2015 but ended the year with a slight increase in the median price to $1.59 M.

- The number of sales in Prospector was on par with last year, but median price rose 13% hitting $833,000.

- Old Town, with seven fewer closed sales than in 2015, ended the year with a median price of $1.48 M – up 12%.

Activity within the Snyderville Basin (84098)

With 366 home sales in 2016 – a 7% increase over last year, the Snyderville Basin accounted for the highest dollar volume in our market area with a median price reaching $968,000.

- With 46 closed sales – 12 more than the previous year, Trailside took a lion’s share of activity in the Basin and also increased 13% in median price to $723,000.

- Jeremy Ranch averaged one sale per week, with a total of 52 closed sales – 11 more than in 2015, and held on to a median price of $922,000.

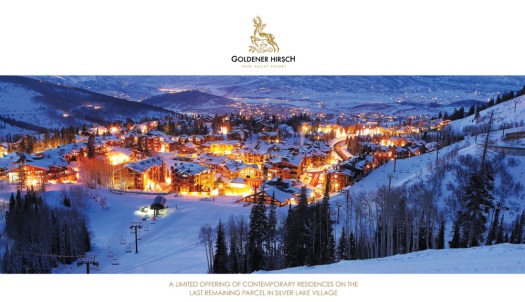

- The number of sales in the Canyons area went from nine to 23, several of which were in the Colony, ending 2016 with a median price of $5.89 M.

- Silver Springs had ten fewer sales than last year, showing some market resistance to rising home prices in that neighborhood. The median price also dipped slightly to $897,000.

- Kimball Junction saw more activity than last year with 16 closed sales and a 12% median price increase to $553,000.

- Promontory climbed 20% in median price, reaching $2 M, and kept pace with last year’s number of sales.

Activity within the Kamas Valley

Overall, single-family home prices in the Kamas Valley rose 22% in 2016, compared to the previous year, with a median price reaching $380,000.

- The Oakley / Weber Canyon area accounted for half of the total number of sales in the Kamas Valley with 45 and ended the year with a $387,000 median price.

- Woodland / Francis saw more activity than in previous years and held on to a median price of $428,000.

Activity within the Heber Valley

With 359 home sales – 111 more than in 2015 – the Heber Valley rivaled the Basin’s number of units sold seeing areas of hot activity, with a median price of $394,000.

- Midway / Charleston had 29 more sales than last year – which is a 38% increase, with a median price was $480,000. Approximately 40% of the homes in Midway are second-homes.

- The Heber City / Daniels area accounted for the bulk of the single family home sales in the Heber Valley with a total of 214 – that is 83 more than 2015. The median price of a home gently coasted to $359,000.

Park City Board of REALTORS®’, Statistics Committee Chair, Carol Agle explains, “Our market area has a bifurcated buyer pool. The market resistance for single family homes seems to be at the $1 million price point and consumers have started to erase any preconceived, artificial delineation of zip codes and addresses.”

Condominium Sales

With 318 condominiums sold in 2016, Snyderville Basin (84098) outpaced the Park City Limits (84060) by 15 units. Despite double-digit price increases in both zip codes, demand continued to be strong in both the City Limits and in the Basin with the median price of $685,000 in town and $468,000 out of town.

City Limits

- Old Town had the highest number of closed sales by neighborhood within the City Limits, averaging two per week with 118 and saw a 26% jump in median price to $568,000.

- Park Meadows had ten fewer sales than the previous year and crept along with a median price close to last year’s number at $565,000.

- Lower Deer Valley, with 24 fewer sales than last year, was up slightly in price to $831,000.

- Prospector, the most affordable neighborhood within the City Limits, had a median price of $139,000.

Snyderville Basin

- With new product closing at Canyons, that area had an uptick in quantity sold, averaging ten sales per month, and saw a 53% jump in median price to $615,000.

- Due to large projects closing at the end of 2015, the Kimball Junction area experienced a decrease in the number of units sold in 2016 but finished the year with a solid 79 closed sales, which is close to two sales per week.

- The Pinebrook area had a solid year with 63 units sold and maintained a steady median price of $437,000.

- The appeal of new product in the Jordanelle area kept buyers’ interested, as can be seen by a 28% increase in the number of sales and median price of $479,000.

Looking Ahead

The number of active properties has remained surprisingly consistent over the last several years, with 1,840 currently listed on the Park City MLS. Prices in our market area have continued to rise year-over-year as both primary and secondary homeowners desire to live, work, and play in Summit and Wasatch Counties. Finding affordable property in certain areas remains challenging with high demand, limited inventory, and rising home prices. Buyers continue to look for value and affordability in outlying communities. With the average home remaining on the market between 7 – 11 months, properties listed at or below their neighborhood median price sell almost 4 times as quickly.

Our market area is complex and constantly changing and evolving with micro-markets dividing product by property type, location, price, age, and amenities. Buyers and sellers are advised to contact a local Park City REALTOR® for information on what is happening in your neighborhood.

Park City, Utah – February 1st, 2017

2016 year-end housing statistics for Summit and Wasatch Counties, as reported by the Park City Board of REALTORS® Multiple Listing Service, show that over the past four years, the number of closed, pended, and active listings has continued to trend at a healthy and stable rate, with an averaged median price increase of 7.5% annually. However, in 2016, the median sales price for single-family homes, condominiums, and vacant land increased at a rate double that number. Overall, the quantity of sold properties did not increase sharply over previous years, yet the dollar volume for our entire market area was up 18%.

President of the Park City Board of REALTORS®, Sara Werbelow adds, “We have experienced a sustainable growth trend for several years. Areas surrounding Park City Proper, such as the Heber Valley and Jordanelle, are proving to be a consistent and robust draw for both primary and secondary homeowners, as buyers are capitalizing on new construction and great value.”

Single-Family Home Sales

Activity within the City Limits (84060)

With limited inventory and high demand for single-family homes within the City Limits, the median price climbed to $1.69 M.

- Lower Deer Valley doubled in the number of homes sold and saw a 15% increase in median price reaching just under $2.2 M.

- Park Meadows, consistently in high-demand, experienced seven fewer sales than in 2015 but ended the year with a slight increase in the median price to $1.59 M.

- The number of sales in Prospector was on par with last year, but median price rose 13% hitting $833,000.

- Old Town, with seven fewer closed sales than in 2015, ended the year with a median price of $1.48 M – up 12%.

Activity within the Snyderville Basin (84098)

With 366 home sales in 2016 – a 7% increase over last year, the Snyderville Basin accounted for the highest dollar volume in our market area with a median price reaching $968,000.

- With 46 closed sales – 12 more than the previous year, Trailside took a lion’s share of activity in the Basin and also increased 13% in median price to $723,000.

- Jeremy Ranch averaged one sale per week, with a total of 52 closed sales – 11 more than in 2015, and held on to a median price of $922,000.

- The number of sales in the Canyons area went from nine to 23, several of which were in the Colony, ending 2016 with a median price of $5.89 M.

- Silver Springs had ten fewer sales than last year, showing some market resistance to rising home prices in that neighborhood. The median price also dipped slightly to $897,000.

- Kimball Junction saw more activity than last year with 16 closed sales and a 12% median price increase to $553,000.

- Promontory climbed 20% in median price, reaching $2 M, and kept pace with last year’s number of sales.

Activity within the Kamas Valley

Overall, single-family home prices in the Kamas Valley rose 22% in 2016, compared to the previous year, with a median price reaching $380,000.

- The Oakley / Weber Canyon area accounted for half of the total number of sales in the Kamas Valley with 45 and ended the year with a $387,000 median price.

- Woodland / Francis saw more activity than in previous years and held on to a median price of $428,000.

Activity within the Heber Valley

With 359 home sales – 111 more than in 2015 – the Heber Valley rivaled the Basin’s number of units sold seeing areas of hot activity, with a median price of $394,000.

- Midway / Charleston had 29 more sales than last year – which is a 38% increase, with a median price was $480,000. Approximately 40% of the homes in Midway are second-homes.

- The Heber City / Daniels area accounted for the bulk of the single family home sales in the Heber Valley with a total of 214 – that is 83 more than 2015. The median price of a home gently coasted to $359,000.

Park City Board of REALTORS®’, Statistics Committee Chair, Carol Agle explains, “Our market area has a bifurcated buyer pool. The market resistance for single family homes seems to be at the $1 million price point and consumers have started to erase any preconceived, artificial delineation of zip codes and addresses.”

Condominium Sales

With 318 condominiums sold in 2016, Snyderville Basin (84098) outpaced the Park City Limits (84060) by 15 units. Despite double-digit price increases in both zip codes, demand continued to be strong in both the City Limits and in the Basin with the median price of $685,000 in town and $468,000 out of town.

City Limits

- Old Town had the highest number of closed sales by neighborhood within the City Limits, averaging two per week with 118 and saw a 26% jump in median price to $568,000.

- Park Meadows had ten fewer sales than the previous year and crept along with a median price close to last year’s number at $565,000.

- Lower Deer Valley, with 24 fewer sales than last year, was up slightly in price to $831,000.

- Prospector, the most affordable neighborhood within the City Limits, had a median price of $139,000.

Snyderville Basin

- With new product closing at Canyons, that area had an uptick in quantity sold, averaging ten sales per month, and saw a 53% jump in median price to $615,000.

- Due to large projects closing at the end of 2015, the Kimball Junction area experienced a decrease in the number of units sold in 2016 but finished the year with a solid 79 closed sales, which is close to two sales per week.

- The Pinebrook area had a solid year with 63 units sold and maintained a steady median price of $437,000.

- The appeal of new product in the Jordanelle area kept buyers’ interested, as can be seen by a 28% increase in the number of sales and median price of $479,000.

Looking Ahead

The number of active properties has remained surprisingly consistent over the last several years, with 1,840 currently listed on the Park City MLS. Prices in our market area have continued to rise year-over-year as both primary and secondary homeowners desire to live, work, and play in Summit and Wasatch Counties. Finding affordable property in certain areas remains challenging with high demand, limited inventory, and rising home prices. Buyers continue to look for value and affordability in outlying communities. With the average home remaining on the market between 7 – 11 months, properties listed at or below their neighborhood median price sell almost 4 times as quickly.

Our market area is complex and constantly changing and evolving with micro-markets dividing product by property type, location, price, age, and amenities. Buyers and sellers are advised to contact a local Park City REALTOR® for information on what is happening in your neighborhood.

Park City, Utah – February 1st, 2017

2016 year-end housing statistics for Summit and Wasatch Counties, as reported by the Park City Board of REALTORS® Multiple Listing Service, show that over the past four years, the number of closed, pended, and active listings has continued to trend at a healthy and stable rate, with an averaged median price increase of 7.5% annually. However, in 2016, the median sales price for single-family homes, condominiums, and vacant land increased at a rate double that number. Overall, the quantity of sold properties did not increase sharply over previous years, yet the dollar volume for our entire market area was up 18%.

[…]

Single-Family Home Sales

Activity within the City Limits (84060)

With limited inventory and high demand for single-family homes within the City Limits, the median price climbed to $1.69 M.

- Lower Deer Valley doubled in the number of homes sold and saw a 15% increase in median price reaching just under $2.2 M.

- Park Meadows, consistently in high-demand, experienced seven fewer sales than in 2015 but ended the year with a slight increase in the median price to $1.59 M.

- The number of sales in Prospector was on par with last year, but median price rose 13% hitting $833,000.

- Old Town, with seven fewer closed sales than in 2015, ended the year with a median price of $1.48 M – up 12%.

Activity within the Snyderville Basin (84098)

With 366 home sales in 2016 – a 7% increase over last year, the Snyderville Basin accounted for the highest dollar volume in our market area with a median price reaching $968,000.

- With 46 closed sales – 12 more than the previous year, Trailside took a lion’s share of activity in the Basin and also increased 13% in median price to $723,000.

- Jeremy Ranch averaged one sale per week, with a total of 52 closed sales – 11 more than in 2015, and held on to a median price of $922,000.

- The number of sales in the Canyons area went from nine to 23, several of which were in the Colony, ending 2016 with a median price of $5.89 M.

- Silver Springs had ten fewer sales than last year, showing some market resistance to rising home prices in that neighborhood. The median price also dipped slightly to $897,000.

- Kimball Junction saw more activity than last year with 16 closed sales and a 12% median price increase to $553,000.

- Promontory climbed 20% in median price, reaching $2 M, and kept pace with last year’s number of sales.

Activity within the Kamas Valley

Overall, single-family home prices in the Kamas Valley rose 22% in 2016, compared to the previous year, with a median price reaching $380,000.

- The Oakley / Weber Canyon area accounted for half of the total number of sales in the Kamas Valley with 45 and ended the year with a $387,000 median price.

- Woodland / Francis saw more activity than in previous years and held on to a median price of $428,000.

Activity within the Heber Valley

With 359 home sales – 111 more than in 2015 – the Heber Valley rivaled the Basin’s number of units sold seeing areas of hot activity, with a median price of $394,000.

- Midway / Charleston had 29 more sales than last year – which is a 38% increase, with a median price was $480,000. Approximately 40% of the homes in Midway are second-homes.

- The Heber City / Daniels area accounted for the bulk of the single family home sales in the Heber Valley with a total of 214 – that is 83 more than 2015. The median price of a home gently coasted to $359,000.

[…]

Condominium Sales

With 318 condominiums sold in 2016, Snyderville Basin (84098) outpaced the Park City Limits (84060) by 15 units. Despite double-digit price increases in both zip codes, demand continued to be strong in both the City Limits and in the Basin with the median price of $685,000 in town and $468,000 out of town.

City Limits

- Old Town had the highest number of closed sales by neighborhood within the City Limits, averaging two per week with 118 and saw a 26% jump in median price to $568,000.

- Park Meadows had ten fewer sales than the previous year and crept along with a median price close to last year’s number at $565,000.

- Lower Deer Valley, with 24 fewer sales than last year, was up slightly in price to $831,000.

- Prospector, the most affordable neighborhood within the City Limits, had a median price of $139,000.

Snyderville Basin

- With new product closing at Canyons, that area had an uptick in quantity sold, averaging ten sales per month, and saw a 53% jump in median price to $615,000.

- Due to large projects closing at the end of 2015, the Kimball Junction area experienced a decrease in the number of units sold in 2016 but finished the year with a solid 79 closed sales, which is close to two sales per week.

- The Pinebrook area had a solid year with 63 units sold and maintained a steady median price of $437,000.

- The appeal of new product in the Jordanelle area kept buyers’ interested, as can be seen by a 28% increase in the number of sales and median price of $479,000.

Looking Ahead

The number of active properties has remained surprisingly consistent over the last several years, with 1,840 currently listed on the Park City MLS. Prices in our market area have continued to rise year-over-year as both primary and secondary homeowners desire to live, work, and play in Summit and Wasatch Counties. Finding affordable property in certain areas remains challenging with high demand, limited inventory, and rising home prices. Buyers continue to look for value and affordability in outlying communities. With the average home remaining on the market between 7 – 11 months, properties listed at or below their neighborhood median price sell almost 4 times as quickly.